Dealing with insurance claims is stressful. This guide provides a step-by-step process for filing a claim, focusing on Ace American Insurance, but applicable to many insurers. We'll help you find the right contact information and navigate the process efficiently and effectively.

Finding the Right Ace American Insurance Claims Phone Number

Before you start, you need the correct phone number. Don't rely solely on online searches as inaccurate numbers are common. Prioritize these sources:

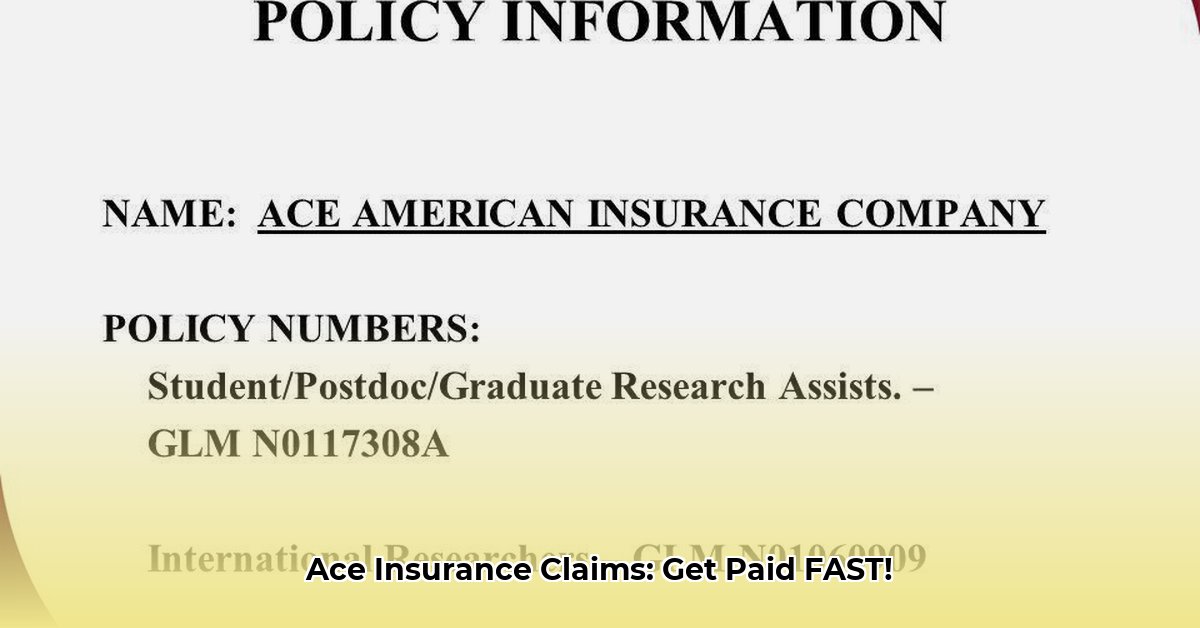

Your Insurance Policy: The most reliable source; check the front page or contact information section.

Ace American's Website: Look for sections like "Contact Us," "Claims," or "Customer Service." The website should clearly list the relevant phone number, potentially separating numbers for different claim types.

Your Insurance Agent: If you worked with an agent, they are a direct point of contact and can provide the correct claim number.

Why is the correct number so important? Calling the wrong number can cause significant delays and frustration. Getting it right from the beginning saves time and stress.

Understanding the Insurance Claim Process: A Step-by-Step Guide

Regardless of your insurer, the claims process generally follows these steps:

Report the Incident: For emergencies (e.g., car accidents, fires), call emergency services first and obtain a report number. This is crucial documentation.

Document Everything: Take clear photos and videos of the damage. Note the date, time, location, and any witnesses. Write a concise factual account of the event. This detailed documentation protects your claim.

Contact Your Insurer: Use the correct Ace American Insurance claims phone number (found above) and clearly explain your situation.

File Your Claim: Follow the insurer's instructions carefully, whether it's filling out an online form or providing specific documents. Accuracy is vital.

Submit Supporting Documents: Provide photos, repair estimates, police reports, etc., promptly. The more complete your submission, the smoother the processing becomes.

Claim Adjuster Review: The adjuster will assess the damage and coverage. They may contact you for additional information or an inspection.

Negotiating Your Settlement (If Necessary): If the initial offer is unsatisfactory, present your case calmly and professionally, backed by your comprehensive documentation from step 2.

Receiving Your Payment: Once the claim is approved, you'll receive payment according to your policy.

Ace American Insurance: A General Overview (Based on Industry Trends)

While specific data on Ace American’s claim processing and customer satisfaction is limited, here's a general overview based on industry benchmarks:

| Feature | Positive Aspects | Potential Challenges |

|---|---|---|

| Claim Processing Speed | Efficient digital processes can lead to faster payouts in some cases. | Delays can occur due to high claim volumes or complex investigations. |

| Customer Service | Many insurers prioritize excellent customer service for client retention. | Wait times and overall experience can vary, so thorough research helps. |

| Policy Coverage Options | A variety of coverage options are typically available to suit individual needs. | Policies may have limitations or exclusions; careful review is essential. |

| Financial Stability | Established insurers generally demonstrate greater financial stability. | Even large insurers can experience challenges; check policy strength. |

This table presents general industry trends and doesn't reflect specific data on Ace American. Independent research is recommended.

Tips for a Smooth Claim Experience

These strategies can improve your experience:

Be Prepared: Have your policy number, incident details, and contact information readily available.

Be Clear and Concise: Explain the situation clearly and avoid unnecessary details.

Be Patient (But Persistent): The process takes time; follow up if delays are excessive.

Keep Records: Document all communications, including dates, times, and names of contacts.

This guide provides helpful information but does not replace official communications from Ace American. Always consult your policy and contact them directly with questions.